Search

Professionals

22-01-14

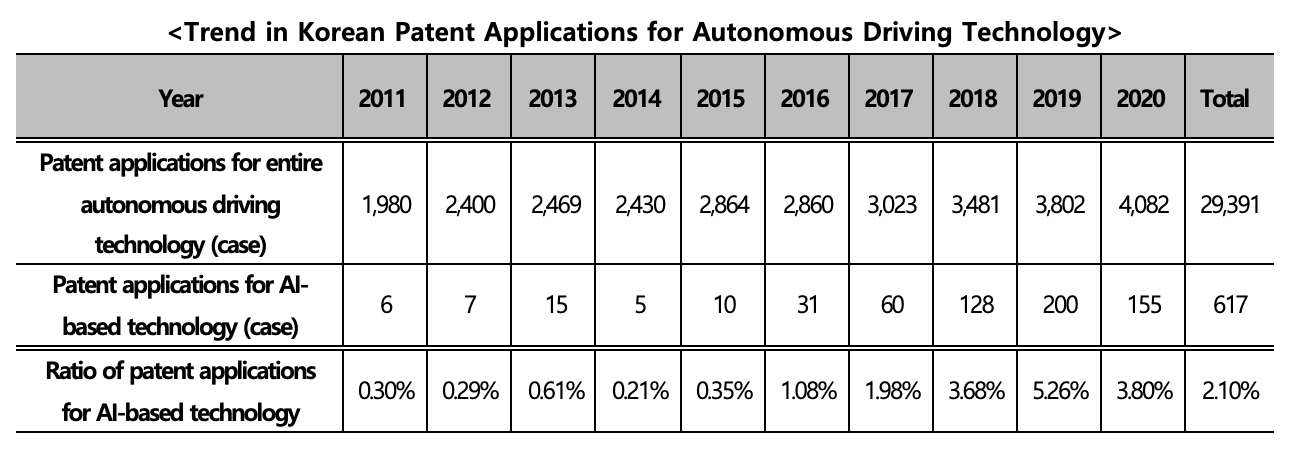

According to the Korean Intellectual Property Office (KIPO), patent applications for artificial intelligence (AI) technology in the autonomous driving field, which have significant influence on the cognition, judgment, and control for autonomous driving of automobiles, have been rapidly increasing since 2016. Patent applications for the autonomous driving were insignificant with less than 15 cases per year until 2015, but have been dramatically increased from 2016, with 31 cases in 2016 and 155 cases in 2020.

Over the past five years (2016-2020), the total number of patent applications for autonomous driving technology has increased by 9.3% annually from 2,860 to 4,082. Among these applications, a ratio of patent applications for AI-based technology in the autonomous driving field also has been increasing from only within 1% before 2016, but exceeding 5% in 2019.

This trend can be attributed to the growing demand for technologies that enhance the safety and reliability of autonomous driving through AI as accidents of autonomous vehicles have been increasing recently.

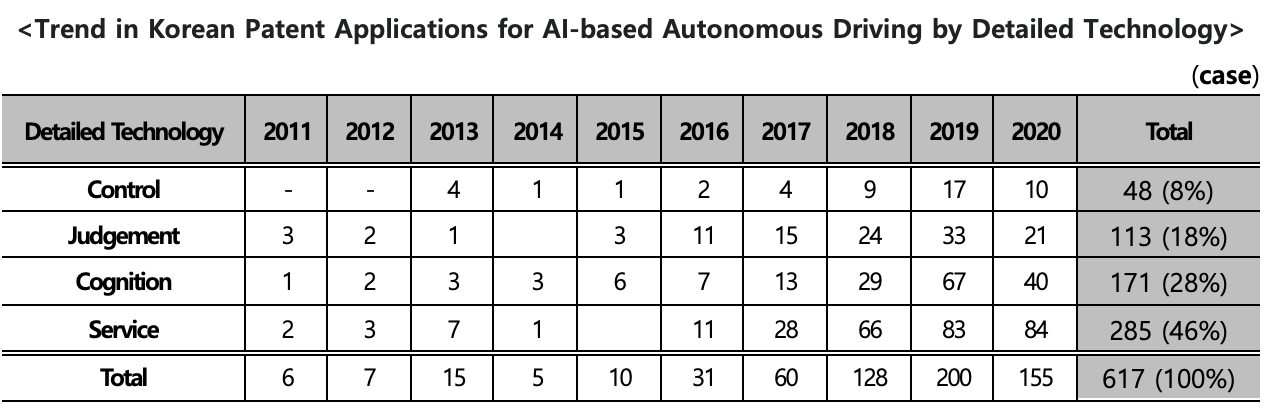

The core AI technologies in the autonomous driving field in which the most patent applications were filed include cognitive technology with 171 applications (28%), judgment technology with 113 applications (18%), and control technology with 48 cases (8%). Cognitive technology, in which the largest number of applications are filed, is believed to be rapidly emerging as the core technological area since it is most important in autonomous driving to accurately identify static environmental information such as lanes and traffic signals and dynamic environmental information such as vehicles and pedestrians.

From 2011 to 2020, Hyundai Motor Company (2,863 cases) and Kia Motors (1,895 cases) filed many applications in the entire autonomous driving field, but LG Electronics filed the most applications for AI-related technology in the autonomous driving field, with 66 cases. Following LG Electronics, Samsung Electronics filed the second most applications with 27 cases, and Hyundai Motor Company came third with 18 cases.

Meanwhile, with the development of autonomous driving technology in full swing, expectations for display (head-up display) technology using the front window of an automobile are also increasing.

According to the Market Research Reports, the market for the head-up displays is expected to reach US $4.6 billion by 2025 from US $1.3 billion in 2020 (an annual average growth of 28.5%).

Thus, as the market for the head-up displays grows, companies' investment and development for head-up displays using augmented reality (AR) are also expanding. Hyundai Mobis is cooperating with and expanding its investment to Envisics, a UK company specializing in digital holograms, to advance hologram-based AR HUD technology (October 2020), and LG Electronics co-developed AR HUD technology that is first to be applied to electric sports utility vehicles (SUVs) with Volkswagen (December 2020).

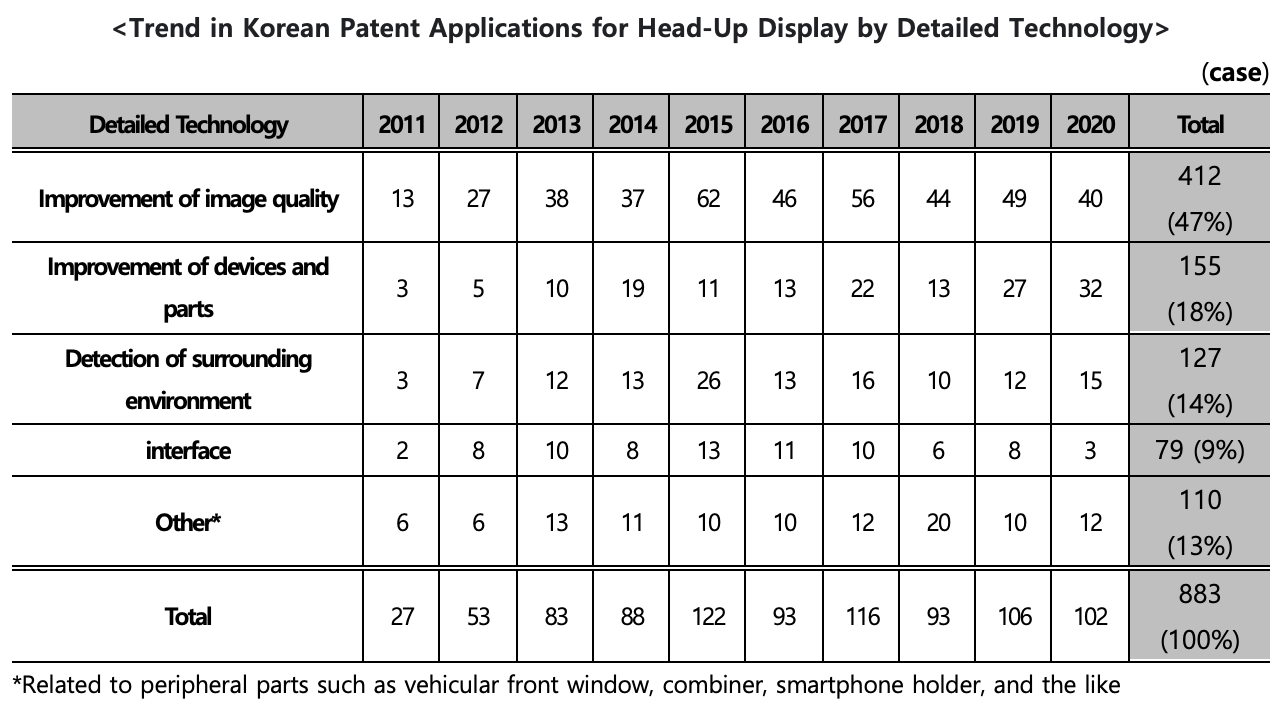

According to the KIPO, patent applications related to head-up displays for automobiles increased by an annual average of 14%, from 27 cases in 2011 to 102 cases in 2020.

By technology, patent applications were mostly filed in technology that improves image quality (412 cases, 47%), followed by technology for miniaturizing devices or preventing performance degradation of parts (155 cases, 18%), technology for detecting a surrounding environment (127 cases, 14%), and interface technology for controlling images using a driver's gestures, glance, or voice (79 cases, 9%).

By applicant, patent applications were actively filed by not only traditional automobile companies such as Hyundai Mobis (93 cases), Hyundai Motor Company (80 cases), and Hyundai Autron (71 cases), but also by companies in electronics/communication industry such as LG Electronics (57 cases), Samsung Electronics (36 cases), LG Innotek (17 cases) and SK Telecom (17 cases).

In addition, with the commercialization of autonomous vehicles and the heightened interest in consumer convenience and road safety, the 4th industrial revolution technologies are converged on roads. As such, the number of patent applications filed for digital roads, which collect, analyze, and process data such as road and traffic information and provide the same to the drivers, more than quadrupled from 53 in 2010 to 219 in 2019, showing an average annual increase of about 17%.

By major technology, there were 665 patent applications filed in digital road infrastructure (SOC) related technology including road infrastructure and traffic management systems, and 369 patent application filed in digital road construction related technology where cutting-edge technology is applied to road planning, design, construction and maintenance.

Autonomous driving technology should converge not only with the conventional automotive technology but also with various technologies such as road and transportation infrastructure. Accordingly, the number of companies sharing patent applications for convergence technologies is expected to increase in view of an increase in joint investment, and joint research and development among companies. As a joint ownership of a patent can be a seed for a dispute among companies with different interests, it would be advantageous to clearly define the ownership of an invention at the beginning of joint investment or joint research and development.